Tribal housing authorities that own and operate affordable housing developments financed with Low Income Housing Tax Credits (LIHTCs) should be aware of IRS final regulation 1.42-5 (iii)(C)(3) that took effect on Feb. 26, 2019.

This regulation affects how state housing finance agency (HFAs) conduct inspections of LIHTC developments. Here’s a quick summary to help:

1. The new procedure reduces the reasonable notice of inspection time from 30 days to 15 days. Exceptions will only be made for extraordinary circumstances, and the only circumstance noted in the regulation is a natural disaster that would prevent an HFA from conducting the inspection.

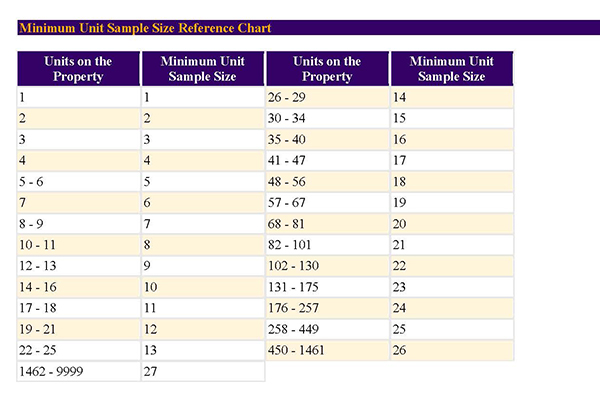

2. The new procedure also changes the sample size minimum requirements to follow the Minimum Unit Sample Size Chart (see below). This is the same chart that is used by HUD/Rural Development for Real Estate Assessment Center (REAC) inspections.

The 20 percent rule previously used is no longer applicable to LIHTC projects. In regard to the number of units selected for an inspection, please keep in mind this new procedure for determining the number of units to be inspected is the Federal Regulation.

HFAs reserve the right to enforce a state-level policy that may lead to a higher number of units to be inspected and/or audited. This new procedure only represents the minimum number of units to inspect.

3. Furthermore, the new procedure prevents HFAs from providing advance notification of the units to be inspected prior to the day of the inspection.

Please note, the updated regulation does not speak about file audits. It should also be noted that recently the IRS, during one of the NCSHA conferences, clarified that the units that are inspected could differ from the certification files that are audited.

HFAs can continue to audit the same units as inspected, but they no longer have to.

If you have any questions, please feel free to email us at assetmanagement@travois.com or call us at 816-994-8970.