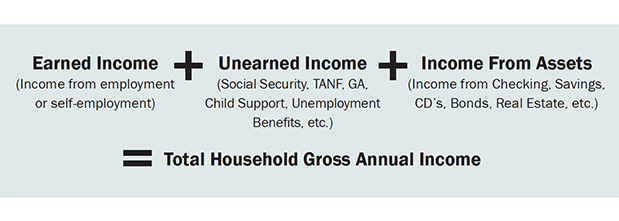

The Low Income Housing Tax Credit (LIHTC) program provides housing for the neediest residents in the country. For compliance professionals, calculating incomes and ensuring residents qualify to live in LIHTC-financed homes requires a careful review of a household’s gross annual income.

This calculation includes earned income (from employment), unearned income (child support, Social Security, TANF and more) and income from assets (savings accounts, bonds and more).

In this blog post, I’ll share an example of how to factor in a Cost of Living Adjustment (COLA) for households who have Social Security and Supplemental Security Income (SSI), which is part of the unearned income portion of the calculation above. For calculating income, we use the monthly amount of benefits before the Medicare amount is deducted.

The Social Security Administration has announced that beginning January 2018 all recipients of Social Security and Supplemental Security Income (SSI) will receive a 2 percent Cost of Living Adjustment (COLA). When completing certifications for households who have Social Security or SSI income, we will need to calculate the 2 percent COLA into their annual anticipated income.

Example of calculating the COLA into annual anticipated income:

Lisa is due to move into her new unit on Dec. 1, and we have verified she receives $650 per month in Social Security benefits. In order to accurately anticipate his annual income, we must include the 2 percent COLA for January through November of 2018.

For December of 2017, we would count the $650 per month. For January through November 2018, we would count $650 + the 2 percent COLA ($13.00) for a total monthly benefit of $663.00.

$650 x 1 = $650.00

$663.00 x 11 = $7293.00

Total annual income from Social Security = $7,943.00

Important note about COLA increases

This 2 percent increase is substantial compared to the previous four years of no increases or very minimal increases. However, for the majority of residents who receive Social Security or SSI benefits in addition to Medicare, they will not see a raise in their net income, not even a penny. People with lower benefits amounts are most likely to encounter this situation.

Most of the time, for our housing developments in Indian Country, we base rents off of a household’s net income amount, so this is important to keep in mind. For the majority of people, rents will remain the same even with the COLA “increase.”

Hold-harmless provision affects this year’s COLA increase

Over the past few years when the COLA was minimal or in some cases non-existent, Medicare Part B premiums continued to rise. For determining an individual’s monthly Part B premium rate, there is a hold-harmless provision in the law that limits the dollar increase in the premium to the dollar increase in an individual’s Social Security benefit.

This provision applies to most beneficiaries who have their Part B premiums deducted from their Social Security benefits, or roughly 70 percent of Part B enrollees in 2016 and 2017. The Social Security Administration did this so people who receive benefits would not have to see a decrease in their net income. The problems begin when the COLA increase is higher or close to the same as the increase in Medicare costs.

In other words, they’ve been getting a break on their Medicare premiums (“held harmless”) in order not to have their Social Security checks reduced due to small COLAs in years past, and that break is now being taken away because of the higher COLA for 2018.

Example of how Social Security benefits are impacted by Medicare premiums

John received a Social Security benefit of $1,300 a month and has a Part B premium of $109 because he was held harmless in past years.

His 2 percent COLA would amount to $26 a month that he would expect to see added to his benefit from Social Security. His new base Medicare premium is $134, and he now has to pay the full amount because the $26 COLA would cover the $25 increase (from $109 to $134), leaving him with a $1 increase in their net Social Security check.

Finding the details in the fine print

Looking closely at explanation letters provided by the Social Security administration about the COLA increase, the hold-harmless language was provided to recipients. However, it can be hard to find and understand.

It’s possible that people will see an increase in their gross annual income even though they are not seeing any change in their net income because the raise in their Medicare premium nullified the COLA increase.

We’re here to help

As always if you have questions about this information or need further assistance, please feel free to call us at 816-994-8970 or email us at assetmanagement@travois.com.